The Taxpayer's Comprehensive Guide to LLCs and Corps

If you're a small business owner, you may be wondering whether to form an LLC or a corporation. Both LLCs and corps offer certain advantages and disadvantages, so it's important to understand the differences between the two before making a decision.

4.5 out of 5

| Language | : | English |

| File size | : | 2161 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 437 pages |

| Lending | : | Enabled |

This comprehensive guide will provide you with everything you need to know about LLCs and corps, including:

- The different types of LLCs and corps

- The advantages and disadvantages of each type of LLC and corp

- How to choose the right LLC or corp for your business

- How to set up an LLC or corp

- How to manage an LLC or corp

The Different Types of LLCs and Corps

There are two main types of LLCs: single-member LLCs and multi-member LLCs. Single-member LLCs are owned by one person, while multi-member LLCs are owned by two or more people.

There are also two main types of corps: C corps and S corps. C corps are traditional corporations, while S corps are pass-through entities. This means that the profits of an S corp are passed through to the owners and taxed on their individual income tax returns.

The Advantages and Disadvantages of LLCs and Corps

LLCs offer a number of advantages over corps, including:

- LLCs are easier to set up and manage than corps.

- LLCs are more flexible than corps.

- LLCs offer liability protection to their owners.

However, LLCs also have some disadvantages, including:

- LLCs are not taxed as favorably as corps.

- LLCs can be more difficult to sell than corps.

Corps offer a number of advantages over LLCs, including:

- Corps are taxed more favorably than LLCs.

- Corps are easier to sell than LLCs.

However, corps also have some disadvantages, including:

- Corps are more difficult to set up and manage than LLCs.

- Corps are less flexible than LLCs.

- Corps do not offer liability protection to their owners.

How to Choose the Right LLC or Corp for Your Business

The best way to choose the right LLC or corp for your business is to consult with an attorney and an accountant. They can help you evaluate the specific needs of your business and recommend the best option for you.

How to Set Up an LLC or Corp

The process of setting up an LLC or corp can be complex, but there are a number of resources available to help you. You can find information on the websites of the Internal Revenue Service (IRS) and the Small Business Administration (SBA). You can also consult with an attorney or an accountant to help you complete the process.

How to Manage an LLC or Corp

Once you have set up an LLC or corp, it is important to manage it properly. This includes filing the correct tax returns, keeping accurate financial records, and holding regular meetings. You can find information on how to manage an LLC or corp on the websites of the IRS and the SBA. You can also consult with an attorney or an accountant to help you manage your LLC or corp.

LLCs and corps are both viable options for small businesses. The best way to choose the right one for your business is to consult with an attorney and an accountant. They can help you evaluate the specific needs of your business and recommend the best option for you.

4.5 out of 5

| Language | : | English |

| File size | : | 2161 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 437 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Jean Georges Vongerichten

Jean Georges Vongerichten Jef Czekaj

Jef Czekaj Richard Panchyk

Richard Panchyk Thornton W Burgess

Thornton W Burgess May Nakamura

May Nakamura Leslie Cabarga

Leslie Cabarga Jane Austen

Jane Austen Pietro La Greca Jr

Pietro La Greca Jr Thomas Roedl

Thomas Roedl John Charles Bennett

John Charles Bennett Jeff Gordon

Jeff Gordon January Harshe

January Harshe Jane Fonda

Jane Fonda Ken Shores

Ken Shores Marissa Zwetow Lmft

Marissa Zwetow Lmft Kenya Clark

Kenya Clark Jeff Howard

Jeff Howard Roma Ligocka

Roma Ligocka Jason Blake

Jason Blake Jeanne Faulkner

Jeanne Faulkner

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Sammy PowellRelive the Hilarious Middle School Years with "Old School Diary of Wimpy Kid...

Sammy PowellRelive the Hilarious Middle School Years with "Old School Diary of Wimpy Kid...

George BellMapping the Landscape of Early Childhood Education: A Comprehensive Guide for...

George BellMapping the Landscape of Early Childhood Education: A Comprehensive Guide for...

Sean TurnerImmerse Yourself in the Enchanting World of Galapagos Birds: An Unparalleled...

Sean TurnerImmerse Yourself in the Enchanting World of Galapagos Birds: An Unparalleled...

Joe SimmonsIntroducing the Handbook of Modern Percussion Revolvers: Your Ultimate Guide...

Joe SimmonsIntroducing the Handbook of Modern Percussion Revolvers: Your Ultimate Guide... Salman RushdieFollow ·3.3k

Salman RushdieFollow ·3.3k Cooper BellFollow ·16.8k

Cooper BellFollow ·16.8k Douglas AdamsFollow ·13.2k

Douglas AdamsFollow ·13.2k Brayden ReedFollow ·11.6k

Brayden ReedFollow ·11.6k Henry JamesFollow ·4.6k

Henry JamesFollow ·4.6k Marcel ProustFollow ·11.7k

Marcel ProustFollow ·11.7k Matt ReedFollow ·6.9k

Matt ReedFollow ·6.9k Brody PowellFollow ·9.7k

Brody PowellFollow ·9.7k

Carlos Drummond

Carlos DrummondHow Companies Win the Mergers and Acquisitions Game:...

In today's...

Craig Blair

Craig BlairMastering The Delicate Balance Between Power And Peace

In today's ever-evolving world, the interplay...

Wade Cox

Wade CoxUnveiling the Zen of Golf: A Journey to Inner Mastery

: The Harmony of Mind,...

Gerald Bell

Gerald BellDarkness Triumphant: Three of the Catmage Chronicles

Synopsis ...

Henry James

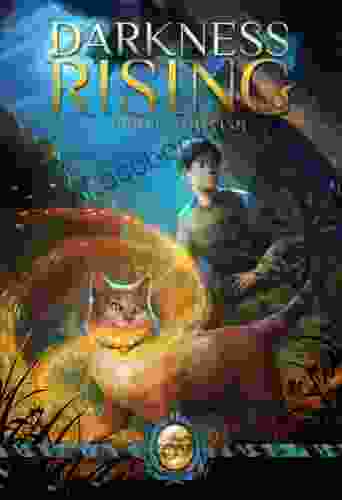

Henry JamesDarkness Rising: One of the Catmage Chronicles

A Captivating Fantasy Adventure...

4.5 out of 5

| Language | : | English |

| File size | : | 2161 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 437 pages |

| Lending | : | Enabled |